Stantec reports strong third quarter 2024 results, raises adjusted diluted EPS guidance and achieves record backlog of $7.3 billion

11/07/2024 EDMONTON, AB; NEW YORK, NY TSX, NYSE:STN

11/07/2024 EDMONTON, AB; NEW YORK, NY TSX, NYSE:STN

Stantec, a global leader in sustainable design and engineering, released its third quarter 2024 results today which are underpinned by continued strong demand and solid project execution.

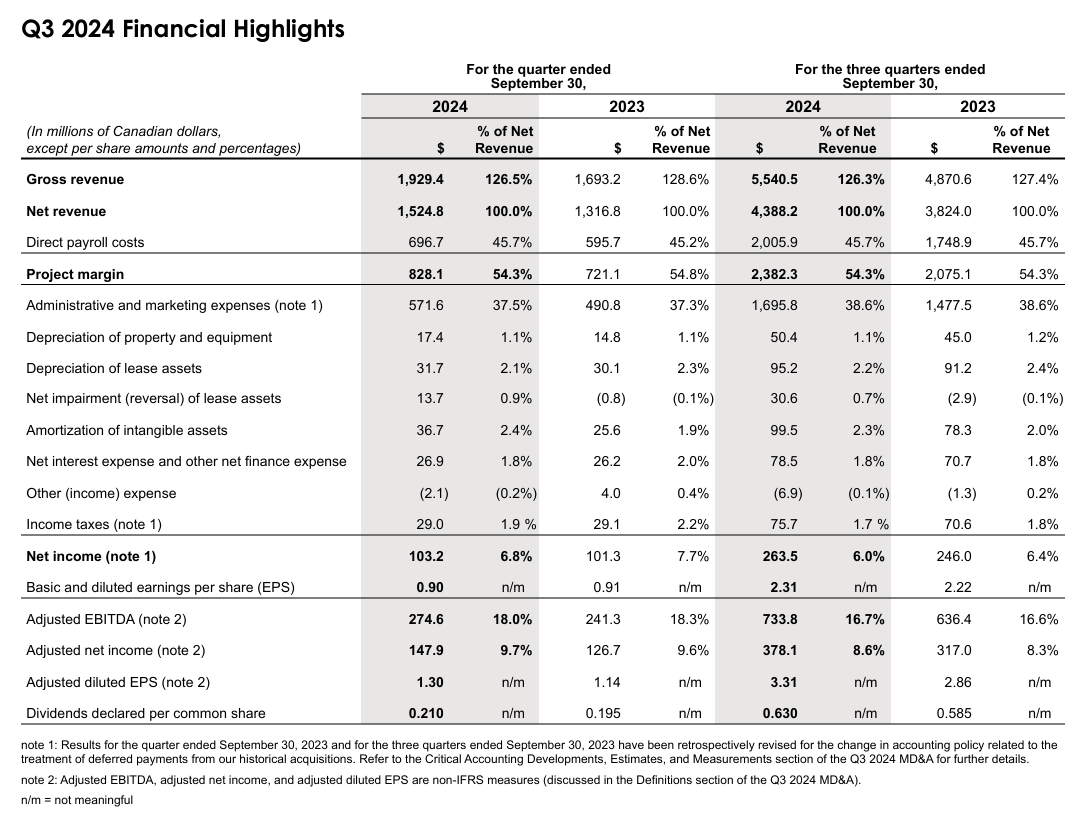

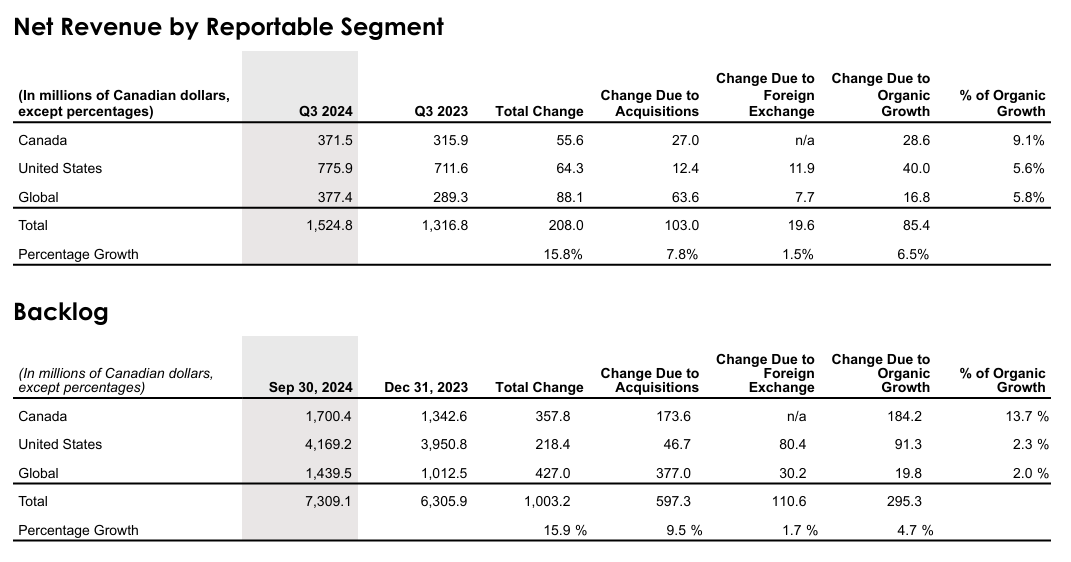

During the quarter, net revenue increased 15.8% year-over-year to $1.5 billion, primarily driven by 7.8% acquisition and 6.5% organic net revenue growth[1]. Organic growth was achieved in each of Stantec's regional and business operating units, with the exception of Energy & Resources. Double-digit organic growth was achieved in both the Water and Buildings businesses of 11.9% and 10.0%, respectively. Adjusted EBITDA for the third quarter of 2024 increased 13.8% or $33.3 million, and adjusted EBITDA margin was 18.0%. Stantec delivered diluted earnings per share (EPS) of $0.90 and adjusted diluted EPS of $1.30, a 14% year-over-year increase. Backlog at September 30, 2024 increased to $7.3 billion, setting a new all-time record.

“Stantec’s momentum continued throughout the third quarter of 2024, showcasing exceptional growth in both revenue and earnings,” said Gord Johnston, President and CEO. "With our strong third quarter results, 2024 is looking to be another record setting year. We now expect to be near the high end of our previously disclosed net revenue range, and we are raising our adjusted EPS outlook for the year,” Mr. Johnston continued, “We’ve made great progress towards our 2024-2026 strategic plan. With our record backlog of $7.3 billion, and a robust set of further growth opportunities in front of us, we are confident we can successfully execute on our plan and continue to deliver compelling shareholder value in the years to come.”

[1] Adjusted diluted EPS, adjusted net income, adjusted EBITDA, and adjusted EBITDA margin are non-IFRS measures, and organic growth, acquisition growth and DSO are other financial measures (discussed in the Definitions section of the Q3 2024 MD&A).

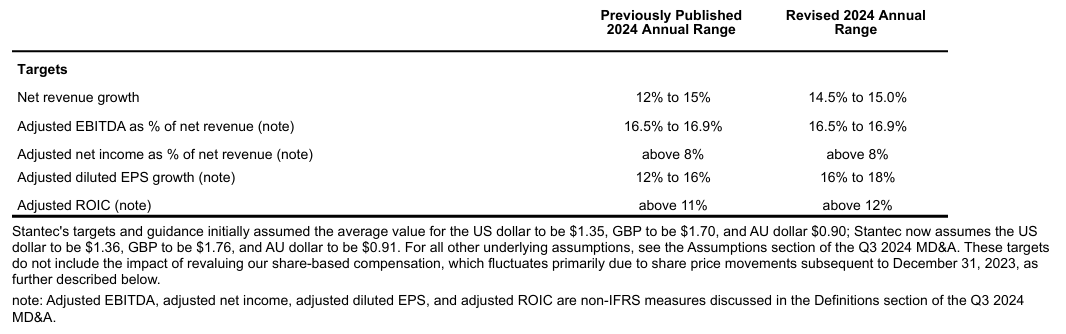

Based on continued strong performance in Q3 2024 and expectations for Q4, Stantec is raising certain targets in our guidance and narrowing ranges further as follows:

Stantec's outlook for net revenue growth remains robust. The Company now expects net revenue growth to be in the range of 14.5% to 15.0% from 12% to 15%. Stantec reaffirms expectations for organic net revenue growth in the mid to high-single digits. The Company continues to expect the US and Global regions to deliver organic growth in the mid to high-single digits and Canada to be in the mid-single digits. Stantec expects acquisition net revenue growth to be in the high-single digits.

The Company's target range for adjusted EBITDA margin remains at 16.5% to 16.9%. This reflects the continuing confidence in solid project execution and operational performance. Stantec continues to expect adjusted net income to achieve a margin above 8%. With the increased expectations for net revenue growth, Stantec now expects adjusted diluted EPS growth to be in the range of 16% to 18% from 12% to 16%, and adjusted ROIC to now be above 12% from 11%.

The retrospective revision impact from the change in accounting policy related to the treatment of deferred payments in a business combination did not have an impact to our targets as the impacts are included as adjusted items associated with acquisition integration costs (see Change in Accounting Policy in Stantec's Q3 2024 MD&A).

Effect of Long-term Incentive Plan

Consistent with guidance previously provided, the targets do not include the impact of revaluing Stantec's share-based compensation, which fluctuates primarily due to share price movements subsequent to December 31, 2023. Year to date, the revaluation resulted in a $2.6 million expense (pre-tax), the equivalent of 6 basis points as a percentage of net revenue and less than $0.02 EPS. If the LTIP metrics existing at Q3 2024 remain constant to the end of the year, the impact of higher share-based compensation expense for the remaining quarter would be negligible, and the full year impact would be approximately $2.0 million (pre-tax) or $0.01 EPS.

The above targets do not include any assumptions for additional acquisitions given the unpredictable nature of the size and timing of such acquisitions, or the impact from share price movements subsequent to December 31, 2023 and the relative total shareholder return components on our share-based compensation programs.

Stantec will host a live webcast and conference call on Friday, November 8, 2024, at 7:00 AM Mountain Time (9:00 AM Eastern Time) to discuss the Company’s third quarter performance.

To listen to the webcast and view the slide presentation, please join here.

If you are an analyst and would like to participate in the Q&A, please register here.

The conference call and slideshow presentation will be broadcast live and archived in their entirety in the Investors section.

Stantec empowers clients, people, and communities to rise to the world’s greatest challenges at a time when the world faces more unprecedented concerns than ever before.

We are a global leader in sustainable architecture, engineering, and environmental consulting.

Our professionals deliver the expertise, technology, and innovation communities need to manage aging infrastructure, demographic and population changes, the energy transition, and more.

Today’s communities transcend geographic borders. At Stantec, community means everyone with an interest in the work that we do—from our project teams and industry colleagues to our clients and the people our work impacts. The diverse perspectives of our partners and interested parties drive us to think beyond what’s previously been done on critical issues like climate change, digital transformation, and future-proofing our cities and infrastructure.

We are engineers, designers, scientists, project managers, and strategic advisors. We innovate at the intersection of community, creativity, and client relationships to advance communities everywhere, so that together we can redefine what’s possible.

Stantec trades on the TSX and the NYSE under the symbol STN.

Non-IFRS and Other Financial Measures

Stantec reports its financial results in accordance with IFRS. This news release also reports the following non-IFRS and other financial measures used by the Company: adjusted EBITDA, adjusted net income, adjusted earnings per share (EPS), net debt to adjusted EBITDA, days sales outstanding (DSO), margin (percentage of net revenue), organic growth (retraction), acquisition growth, adjusted return on invested capital (ROIC), and measures described as on a constant currency basis and the impact of foreign exchange or currency fluctuations, as well as measures and ratios calculated using these non-IFRS or other financial measures. Additional disclosure for these non-IFRS and other financial measures, incorporated by reference, is included in the Definitions of Non-IFRS and Other Financial Measures section of the Q3 2024 Management’s Discussion and Analysis, available on SEDAR+ at sedarplus.ca, EDGAR at sec.gov, and the Company’s website at Stantec.com and the reconciliation of Non-IFRS Financial Measures appended hereto.

These non-IFRS and other financial measures do not have a standardized meaning under IFRS and, therefore, may not be comparable to similar measures presented by other issuers. Management believes that, in addition to conventional measures prepared in accordance with IFRS, these non-IFRS and other financial measures and ratios provide useful information to investors to assist them in understanding components of the Company's financial results. These measures should not be considered in isolation or viewed as a substitute for the related financial information prepared in accordance with IFRS.

Forward-looking Statements

Certain statements contained in this news release constitute forward-looking statements. These statements include, without limitation, comments regarding the Company's ability to capture future growth opportunities, adjusted diluted EPS and net revenue growth, adjusted EBITDA margin, adjusted ROIC, and the 2024 outlook. Readers of this news release are cautioned not to place undue reliance on forward-looking statements since a number of factors could cause actual future results to differ materially from the expectations expressed in these forward-looking statements. These factors include, but are not limited to, the risk of economic downturn, cash flow projections, project cancellations, access and retention of skilled labor, decreased infrastructure spending levels, decrease or end to stimulus programs, changing market conditions for Stantec’s services, and the risk that Stantec fails to capitalize on its strategic initiatives. Investors and the public should carefully consider these factors, other uncertainties, and potential events, as well as the inherent uncertainty of forward-looking statements, when relying on these statements to make decisions with respect to the Company.

Future outcomes relating to forward-looking statements may be influenced by many factors and material risks. For the three and nine month periods ended September 30, 2024, there has been no significant change in the risk factors from those described in Stantec's 2023 Annual Report. This report is accessible online by visiting EDGAR on the SEC website at sec.gov or by visiting the CSA website at sedarplus.ca or Stantec’s website, Stantec.com. You may obtain a hard copy of the 2023 annual report free of charge from the investor contact noted below.

Investor Contact

Jess Nieukerk

Stantec Investor Relations

Ph: 403-569-5389

jess.nieukerk@stantec.com

To subscribe to Stantec’s email news alerts, please fill out the subscription form.