Aligning ESG in commercial real estate

June 13, 2024

June 13, 2024

The desire for a sustainable workplace that meets organizational goals is reshaping the market for office buildings

Let’s talk about ESG in commercial real estate. Owners and tenants can benefit from aligning their ESG goals in their offices and commercial spaces. Tenants want to attract people to work for their companies that align with their vision and values. Today’s companies have corporate goals, ESG (environmental, social, governance) policies that guide them. They want spaces that reflect these ESG goals and policies.

To better understand what ESG means for buildings, particularly ESG in commercial real estate, think about why tenants and owners want to align their buildings with their ESG goals. What kind of benefits should they expect from setting building and office decarbonization goals that align with their ESG policies? What kinds of ESG-related demands for the office are typical for tenants and owners? And once they are committed to ESG alignment in their buildings, how can they make it happen? What kind of strategies are available to them?

140 Kendrick Street’s Building A is the first net zero carbon office repositioning of this scale in Massachusetts. The key driver for the Building A retrofit was the alignment of environmental, social, and governance (ESG) ambitions held by BXP and Wellington Management.

They are issuing ESG reports. BDO reports that 99 percent of the S&P 500 companies do some form of ESG reporting today. Ideally, an ESG program means full transparency so management, investors, and employees can see how a company operates. ESG requires reporting on greenhouse gas (GHG) emissions from operations and/or new capital projects. The E in ESG often focuses on the impact of an organization’s real estate on the environment. Building construction and operations consume resources and emit carbon. So, ESG positively views an organization’s efforts to reduce emissions from the spaces it uses.

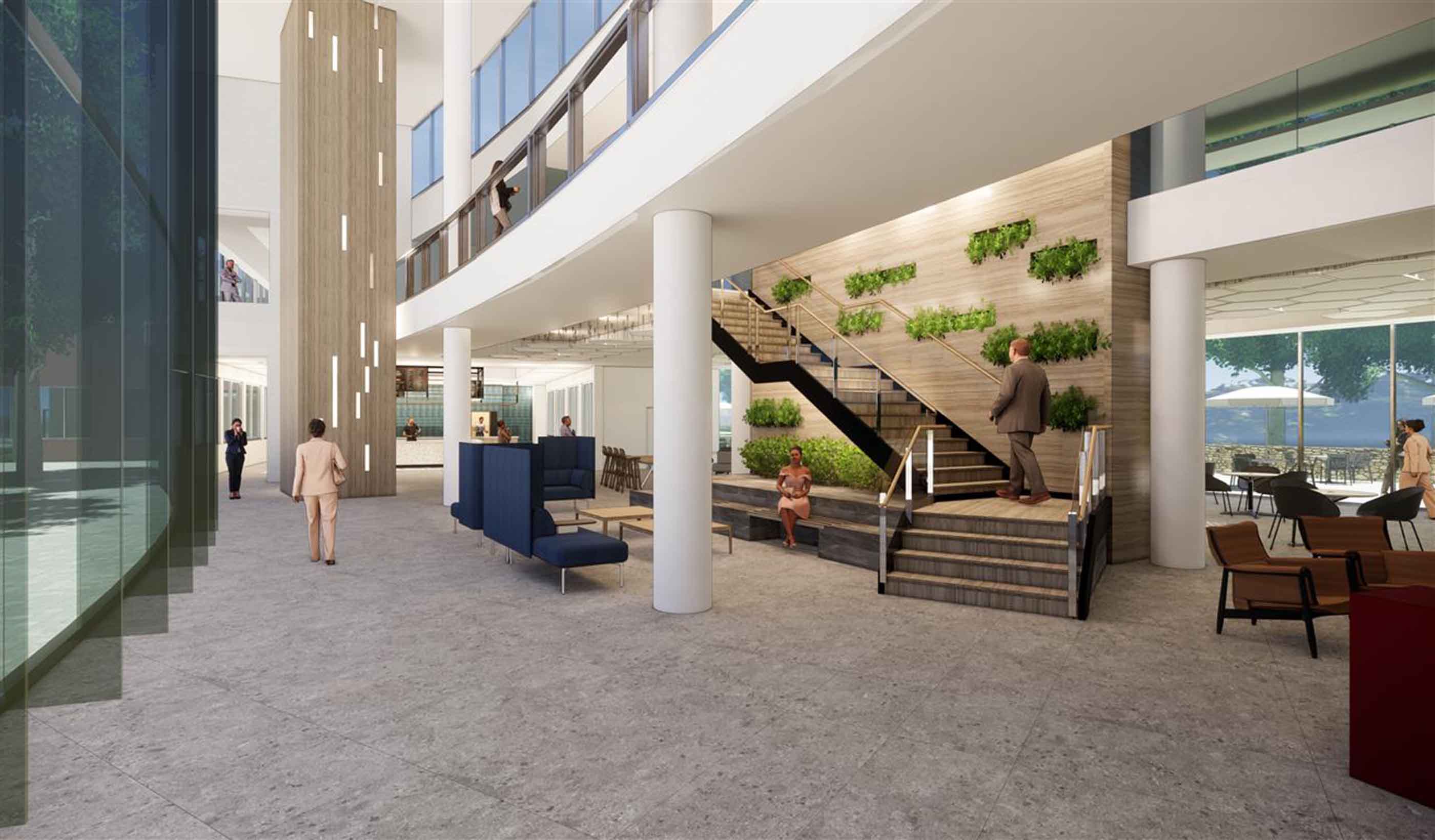

Space can express a brand and recruit talent. Forward-looking tenants want the office to reflect their brand. For them, the workplace is an extension of culture, engagement, attraction, and retention. They want to work in an inspiring place that shows their values and their ESG goals.

Office tenants want to attract talent to their organizations. Generation Z looks for a good fit between its ideals and a potential employer’s practices. A 2023 Deloitte survey of millennials and Gen Z says they “continue to make lifestyle and career decisions based on their values.” Over half of these groups say they research a brand’s environmental impact before accepting a job offer.

The Gen Z and millennial workforce wants to work in spaces that reflect a corporate culture and purpose. If office tenants can tell a powerful story about their decarbonization efforts and low-emissions workplace, they can help recruit the best talent. Net zero buildings can tell a story. Repositioning an office building or site as part of a net zero, carbon-neutral campus to meet ESG goals can make a difference in recruiting.

Here's an example: 140 Kendrick Street, Building A in Boston, Massachusetts. It is the first Mass Save Net Zero carbon office repositioning of a 100,000-square-foot building in the state. Boston Properties, Inc. (BXP) and its tenant, Wellington Management, wanted to align their ESG ambitions in the Building A retrofit. The result is a net zero, carbon-neutral campus that speaks to Gen Z and millennial talent.

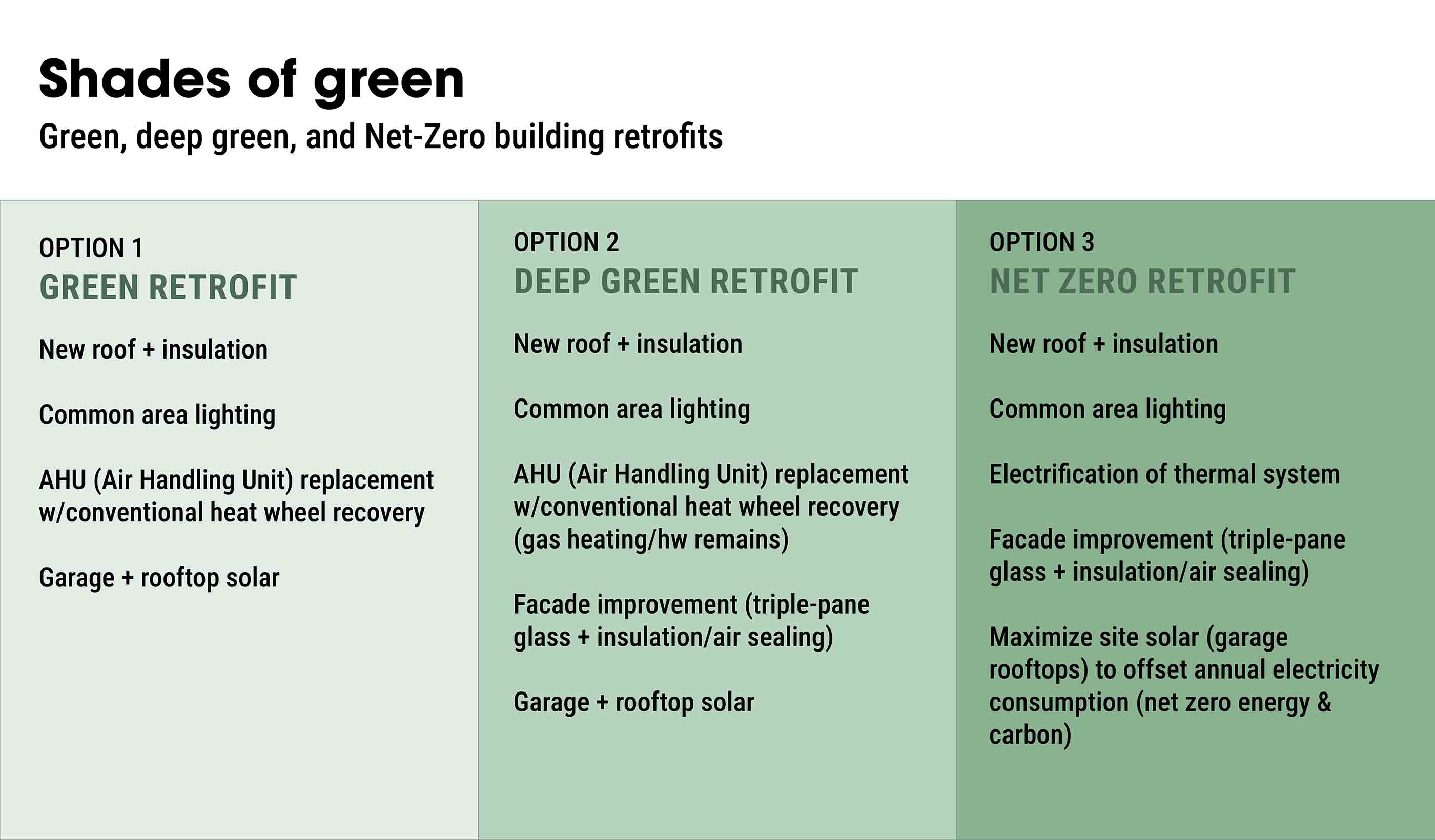

Sample set of retrofit options for an existing commercial building.

Aligning ESG goals means aligning interests. Developers may have their own ESG goals around GHG emissions. Their ESG commitments give them an incentive to strive to attract tenant clients that operate along similar guidelines. Making a match will benefit them both. They’re more likely to find common ground around what an ESG-compliant space looks like. And they are more likely to share an understanding that a high-quality, ESG-compliant space comes with a premium cost.

A space that reflects ESG goals can stand out in the market. Landlords that offer spaces that align with ESG goals will gain a potential advantage in the marketplace. Spaces with demonstrably low emissions and design features that support wellness are often preferred. This can help them attract and retain high-quality tenants and charge higher rents. According to CBRE, US office rents for LEED-certified office buildings are 5.6 percent higher than those for comparable noncertified buildings. And LEED Platinum-certified office buildings command an even higher premium.

In many areas, new regulations are encouraging building owners and operators to reduce their building emissions. In New York, for example, the fines for those that don’t begin to bite in 2024. The Real Estate Board of New York estimates that thousands of buildings could face fines totaling more than $200 million annually. Eventually, we believe, the demand for low-carbon, high-quality buildings in major cities will outstrip the supply. If landlords and owner/occupiers don’t upgrade their buildings, the marketability of their buildings will likely suffer. Building owners in New York that haven’t repositioned to comply with Local Law 97 may end up with stranded assets, that is, undesirable buildings.

Successful businesses and organizations tend to expand. When corporations expand their business footprint, however, they usually increase their carbon emissions. This makes it difficult for them to target net zero emissions by 2030. One way to balance growth and minimize carbon impact is for companies to reuse buildings whenever possible. Through reuse, they can take advantage of the sunk carbon costs in the building vs. building new. And their ESG reporting should account for the emissions (embodied carbon) that they are saving through reuse.

They can justify this reuse before they commit to it. We can model and estimate the potential carbon and budget savings on building retrofitting projects versus demolition and building new ones. We can predict the percentage reduction in overall building energy use and the payback time for various energy retrofitting strategies. Our energy audits and modeling for national clients have shown this works. Often, the cost and energy savings greater than 40 percent are possible, with a payback time of 10 years on significant retrofits.

Tenants are prioritizing employee performance/experience: Tenants are looking for spaces with daylighting, views, and healthy air ventilation. They all enhance employee well-being. Tenants desire a workplace design that can improve the productivity, health, and satisfaction of their employees and visitors.

For example, Denver Water takes great pride in its healthy work environment. We designed the Denver Water Administration Building to meet its needs. It has a robust envelope and superior daylighting, which provides thermal protection/low air infiltration to promote wellness and save on operational costs.

Tenants are committed to carbon reductions and net zero goals: They want efficient offices that minimize their energy consumption, utility costs, and comply with new building performance standards.

Developers may have their own ESG goals around GHG emissions. Their ESG commitments give them an incentive to strive to attract tenant clients that operate along similar guidelines.

On average, America’s Energy Star-certified buildings use 35 percent less energy than noncertified properties. The EPA says that, as a result, certified buildings save businesses billions of dollars a year. Bonus? Studies show a lower default risk for Energy Star-labeled buildings. So, they often get better loan terms.

Retrofitting commercial buildings for building performance standards puts them in a better position in the marketplace.

Tenants want to verify and confirm their building performance: They want offices that go beyond the basics for sustainability. They will be looking for a building with certifications such as LEED or the WELL building standard.

A building like 140 Kendrick Building A, for example, not only achieved Mass Save Net Zero. But it is also targeting LEED Zero Carbon and LEED Core and Shell Gold certifications. These designations matter.

Tenants want to show their leadership: They want a space that showcases pioneering approaches. Take mass timber, for example. If the building uses timber as a low embodied carbon material, the tenants want to see it. They may choose similar materials for replacement and retrofitting. They appreciate features that show their commitment to sustainability and social responsibility, while also meeting the expectations of investors and stakeholders.

For example, in its Buffalo Crossing Visitor Centre, FortWhyte Alive puts mass timber design on display. It shows leadership and commitment to its mission around sustainability in the Winnipeg community.

With a rooftop PV array, a retrofitted building can generate clean energy and offset its energy consumption from the grid.

Tenants and landlords can use green leases that use metrics to ensure they are meeting their ESG goals. These rental agreements can include obligations regarding operations and energy retrofits. The leases work on both ends. A tenant can require the landlord to maintain an Energy Star certification. And a landlord could require a tenant to provide all utility data. Owners and tenants can consider green or solar power purchase agreements to facilitate the purchase of renewable energy. Tenants such as IBM and Lend Lease use green leasing to meet net zero targets. Subaru of America purchases 100 percent renewable wind power for its New Jersey headquarters, for example.

To get started on preparing a building for ESG alignment, owner/operators can commission a study for their properties. Then they can plan for upgrading their buildings to comply with local laws and ESG goals.

We are currently performing ASHRAE Level 2 audits on two mid-rise buildings in St. Johns, Newfoundland, for East Port Properties. The audit results will inform decisions around building upgrades to reduce energy consumption and the possibility of purchasing off-site renewable energy to achieve net zero.

Owners can invest in design features and systems upgrades that support occupant well-being and reduce their building’s energy appetite. Within their capital expenditure plans, they can prioritize energy conservation measures. These may include window upgrades, a smart HVAC control system, lighting controls, efficient heating and cooling system upgrades, and window shading. They can investigate reskinning, which is replacing the façade with a new one that makes the building more efficient and controls solar gain. When reskinning is done with other retrofits, it can achieve significant energy reductions.

For example, we worked with a technology client to reskin an industrial building and transform it into a low-carbon, 650,000-square-foot workplace. This adaptive reuse project included reskinning, strategic MEP systems, onsite renewables, and healthy materials. The building has LEED Platinum, Green Globe, and WELL Building certifications.

Ambitious building owners can look into onsite renewables, such rooftop photovoltaics. We have seen clients use onsite solar on large sites and become their own electricity provider—making the building attractive for leasing from a low carbon and resiliency perspective. They can even sell renewable energy credits to their tenants. While it is connected to the grid, 140 Kendrick Building A’s onsite renewables are likely to cover its annual energy use. We look forward to reviewing the building’s post-occupancy data when it is available.

We encourage owners, operators, and tenants to go beyond the code minimum and do more. Making those low carbon/zero emissions updates can position their buildings to comply with green codes and pursue certifications. Even if they aren’t subject to new regulations, they will likely benefit from lower utility bills and higher tenant demand in the long run.

Alignment around ESG in commercial real estate will drive a robust market for net zero carbon offices. Both tenants and landlords can win by aligning their ESG goals.